The Hidden Costs of Renting.

Renting has long been considered a convenient housing option, providing flexibility and freedom for many individuals and families. However, it's crucial to understand that renting is not without its downsides. One of the most significant drawbacks is that, unlike homeownership, renting does not allow you to build equity through mortgage paydown or benefit from potential property appreciation. In this blog, I'll explore these key aspects of renting and why they should be considered when deciding on your housing situation.

1. No Mortgage Paydown:

When you rent a property, you make monthly payments to your landlord, but these payments do not contribute to the ownership of the property. In contrast, homeowners who pay a mortgage gradually build equity in their homes with each payment. Equity represents the portion of the property that you own, and it can be a valuable asset that grows over time. While rent payments provide you with a place to live, they don't offer the long-term financial benefit of owning a property.

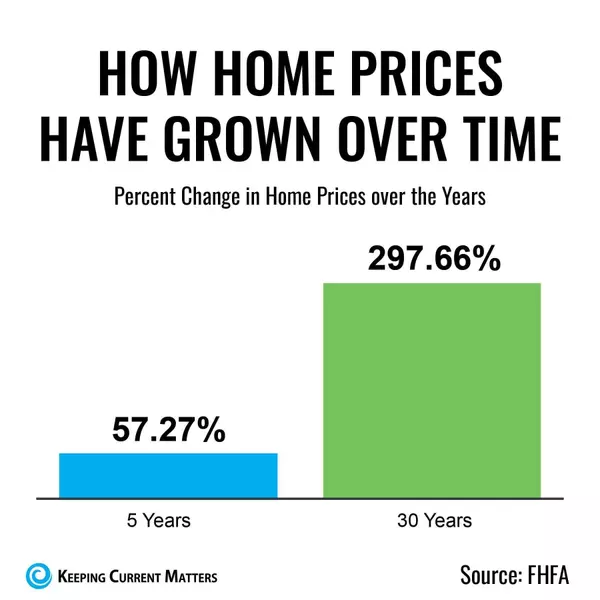

2. No Appreciation:

One of the most compelling arguments for homeownership is the potential for property appreciation. Over time, real estate values tend to increase, allowing homeowners to benefit from the appreciation of their property's value. This can lead to significant financial gains if and when you decide to sell your home. In contrast, renters do not participate in the potential appreciation of the properties they live in. Instead, they watch as their landlord's investment appreciates without any direct financial gain.

3. Missed Investment Opportunities:

Homeownership not only provides a place to live but can also be a wise long-term investment. Owning property allows you to leverage your investment by using your home as collateral for loans, refinancing, or even generating rental income through real estate investment. Renters miss out on these opportunities and have fewer options for leveraging their housing expenses to build wealth.

4. Lack of Control:

Renters often face restrictions on making structural or aesthetic changes to their homes. As a homeowner, you have the freedom to modify and improve your property as you see fit. This can increase the value of your home and enhance your living experience.

5. Renting Costs Over Time:

Renting can sometimes be more expensive than homeownership over the long term. Rent prices tend to increase over time due to inflation and market demand, while homeowners with fixed-rate mortgages can benefit from stable housing costs.

6. Tax Benefits:

Homeowners can often take advantage of various tax benefits, such as mortgage interest deductions and property tax deductions, which can help reduce their overall tax burden. Renters do not have access to these financial advantages.

In conclusion, while renting can offer short-term flexibility and convenience, it comes with significant financial trade-offs. The absence of mortgage paydown, missed appreciation opportunities, and fewer financial benefits make renting a less attractive option for those looking to secure their financial future. Homeownership provides the potential for long-term financial security, wealth accumulation, and the freedom to create a place that truly feels like home. It's essential to consider these factors when deciding on your housing situation, as homeownership may be a better path toward financial stability.

Categories

Recent Posts